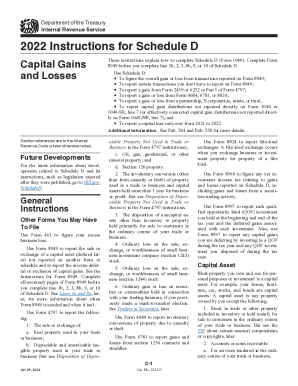

Irs Form 1040 Schedule D Instructions 2024 Printable – The 1040 2023 Instructions report it on Schedule D (Form 1040), Capital Gains and Losses. A taxpayer who disposed of any digital asset by gift may be required to file Form 709, United States Gift . you’ll need to fill out IRS Form 1098, which you should receive from your lender in early 2024. You can then enter the amount from Line 1 on that Form 1098 into Line 8 of 1040 Schedule A. .

Irs Form 1040 Schedule D Instructions 2024 Printable

Source : www.irs.govU.S. Individual Income Tax Return Income

Source : www.irs.gov1040 (2023) | Internal Revenue Service

Source : www.irs.gov2023 Form 1040 SR

Source : www.irs.gov1040 (2023) | Internal Revenue Service

Source : www.irs.govSchedule d tax worksheet: Fill out & sign online | DocHub

Source : www.dochub.com1040 (2023) | Internal Revenue Service

Source : www.irs.govAll About Schedule A (Form 1040 or 1040 SR): Itemized Deductions

Source : www.investopedia.com1040 (2023) | Internal Revenue Service

Source : www.irs.govIRS 1040 Schedule D Instructions 2022 2024 Fill and Sign

Source : www.uslegalforms.comIrs Form 1040 Schedule D Instructions 2024 Printable 1040 (2023) | Internal Revenue Service: The IRS has three different versions of the Form 1040 that you can use to file your taxes: 1040, 1040-SR, and 1040-NR. Here are the key differences. The IRS has over 800 different forms and . Reviewed by Lea D. UraduFact checked by Kirsten Rohrs Schmitt Most taxpayers use Form 1040: U.S. Individual Income Tax Return to file their annual tax returns. Before the tax year 2018 .

]]>

:max_bytes(150000):strip_icc()/ScheduleA2023-641f841b859949f28b094e61efecc58b.png)